Finance teams know the drill. Accounts payable feels like wrestling with a hydra; cut off one manual process, and two more sprout up. Purchase orders get lost in email chains. Invoices pile up in approval limbo. Reconciliation turns into archaeological expeditions through spreadsheets that haven’t been updated since the Clinton administration. Manual data entry and human error in these processes often lead to financial discrepancies, delays, and a lack of transparency, making the situation even more challenging.

The problem isn’t that AP teams lack motivation. It’s that traditional accounts payable infrastructure was built for a world where everything moved at the speed of paper checks and three-day settlement windows. Manual methods slow down the entire AP process and create bottlenecks at every stage, from invoice receipt to payment. But in 2025, businesses need payment systems that can keep up with the pace of modern commerce. And virtual cards might just be the game-changer that makes AP modernization actually work.

Why Traditional AP Processes Are Breaking Down

Traditional accounts payable wasn’t designed for the complexity of modern B2B commerce. Most AP departments are still running on systems that treat every payment like a one-off transaction, creating bottlenecks that compound with scale. Manual data entry increases processing time and the risk of duplicate payments, making the process inefficient and prone to costly errors. Manual entry of invoice details is a common source of errors and delays, further highlighting the need for automation.

Manual Processes Everywhere

The average invoice touches seven different people before it gets paid. That’s seven opportunities for delay, error, and the kind of friction that makes vendors start demanding payment up front. Paper invoices get misfiled. Digital ones get buried in email threads. Manual invoice processing and the absence of automated invoice matching can lead to errors in invoice data, increasing the risk of duplicate payments and inaccurate records. Approval workflows stall when key stakeholders are traveling or just plain overwhelmed.

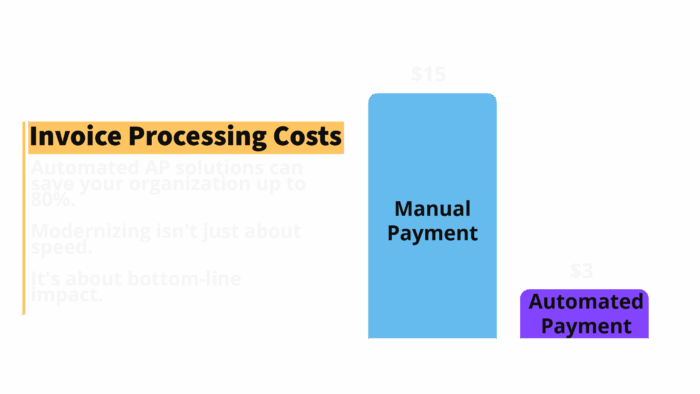

It’s no surprise that all these handoffs and errors drives up the cost to process a single transaction. Ardent Partners reported that invoices processed without automation can cost companies anywhere from $12 – $15 a pop.

Fraud Vulnerabilities

The AFP’s 2023 Payments Fraud survey reported that 65% of organizations were victims of payment fraud. While 42% of that was specifically in check fraud, and risks with wiring funds isn’t far behind. Traditional payment methods put businesses in a reactive position. By the time you discover fraudulent activity, the money is already gone. Most AP systems rely on manual oversight and basic approval hierarchies that can’t keep up with increasingly sophisticated fraud schemes. Digital payment technologies can enhance internal controls by streamlining invoice approval and establishing audit trails, while also providing an additional layer of security through features like tokenization and encryption to increase security against fraud.

Settlement Speed Problems

ACH transfers take days. Wires are expensive and require manual intervention. Checks are basically time machines that transport your payment back to 1960. Meanwhile, your suppliers are dealing with their own cash flow challenges and increasingly demanding faster payment terms to stay competitive. Automation enables timely payments and faster payments, allowing businesses to capture early payment discounts and strengthen supplier relationships. This has put Days Payable Outstanding (DPO) under scrutiny and many businesses are facing investor pressure to pay suppliers faster while still keeping their working capital optimized.

Where Virtual Cards Transform B2B Payments

Virtual cards aren’t just digitized versions of plastic cards. They’re programmable payment instruments that can solve specific business problems and companies are quickly seeing the benefit. According to the 2024 Nilson Report, virtual cards are the fastest growing segment of U.S. commercial card spending and is projected to reach $2 trillion globally by 2028.

Virtual cards facilitate online payments and electronic payments, making it easier for businesses to process payments using secure digital payment methods.

Wondering why virtual card usage is booming? Because 84% of finance leaders say virtual cards improve their reconciliation accuracy and audit readiness. Here’s where they’re making the biggest impact:

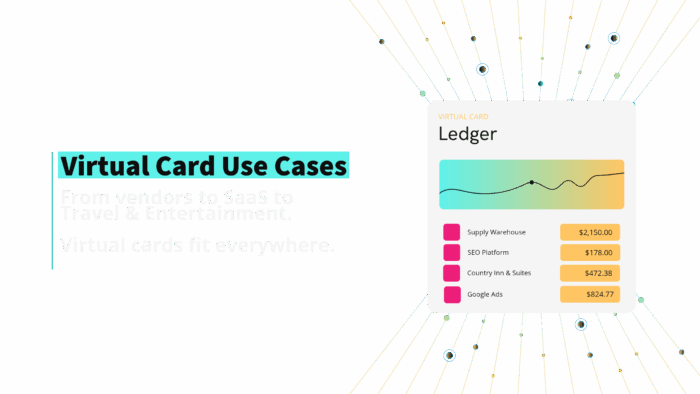

Vendor Payments

Instead of cutting individual checks or initiating separate wire transfers for each vendor, finance teams can generate virtual cards with specific spending limits and merchant restrictions. Each card can be tied to a particular invoice or purchase order, creating an automatic audit trail that eliminates most reconciliation headaches. Automated reconciliation, enabled by accounts payable automation platforms and an AP automation solution, further streamlines vendor payments and improves accuracy by matching payment data with invoices automatically.

Subscription Management

B2B subscriptions are multiplying faster than finance teams can track them. Marketing has three different analytics platforms. IT has four security subscriptions that auto-renew at different times. Sales has a CRM plus five add-on tools that all bill separately. Virtual cards let you assign unique card numbers to each subscription, making it easy to track spending and cancel services without disrupting other payments. Automated invoice management further helps finance teams stay on top of recurring payments and avoid missed renewals by streamlining the entire invoice processing cycle.

Travel and Expense Programs

Business travel is back, but expense reporting is still painful. Virtual cards can be generated for specific trips or employees with built-in controls for merchant categories, spending limits, and geographic restrictions. Instead of employees fronting money and waiting for reimbursement, they get payment tools that work within company policies from day one. An automated approval workflow ensures that travel expenses are reviewed and approved efficiently, streamlining the process and reducing manual effort.

Media and Marketing Spend

Digital advertising platforms want credit cards on file for automatic billing, but marketing budgets change quickly and platforms can be unreliable about spending controls. Virtual cards give marketing teams the flexibility they need while giving finance the oversight they require. Additionally, value added services from virtual card platforms provide marketing teams with enhanced data insights and streamlined payment processes.

The Real Benefits: Beyond Convenience

Virtual cards aren’t just about making payments easier. They’re about making accounts payable smarter.

By leveraging automation, virtual cards deliver cost savings by reducing manual work, lower costs through streamlined processes, and saving time for finance teams.

Instant Issuance and Control

Need to pay a new vendor today? Generate a virtual card in just a few clicks, with exactly the spending limit and merchant restrictions you need. No waiting for plastic cards to arrive in the mail. No lengthy vendor onboarding processes. Just immediate payment capability with built-in controls.

Granular Merchant Controls

Every virtual card can be programmed with specific rules about where and how it can be used. A card for office supplies can be restricted to specific vendors and spending categories. A card for a marketing campaign can be limited to particular advertising platforms and time periods. These controls aren’t just suggestions, they’re technical restrictions enforced at the transaction level. Controlled access ensures that only authorized users can issue or modify virtual card settings, further enhancing security and compliance.

Automatic Rebates and Cash Flow

Many virtual card programs offer rebates on B2B spending, turning your accounts payable into a small profit center. More importantly, virtual cards settle immediately but can be funded from corporate accounts on standard terms, improving cash flow compared to traditional payment methods. Transaction data flows directly into accounting systems, and this integration streamlines the management of financial records by organizing, storing, and providing easy access to business financial data. Unlike ACH, which costs businesses up to $1.50 per transaction, virtual car rebates can turn AP into a net revenue generator – with some enterprises reportedly reaping $250k+ annually in rebates.

Real-Time Visibility

Traditional payment methods create information delays. You send a wire on Tuesday, but don’t know if it was received until Thursday when the vendor confirms. Virtual card transactions provide immediate confirmation and detailed transaction data that flows directly into your accounting systems. This real-time information empowers finance teams to make more informed decisions.

Qolo’s Virtual Card Issuing: Built for Modern AP

Qolo’s Qinetic Issuing platform addresses the specific challenges of B2B accounts payable with virtual cards that integrate directly into your existing financial infrastructure. As AP software, Qolo supports AP automation, payable automation, and accounts payable automation, enabling modern businesses to streamline invoice processing, approval workflows, and payments with greater efficiency and control.

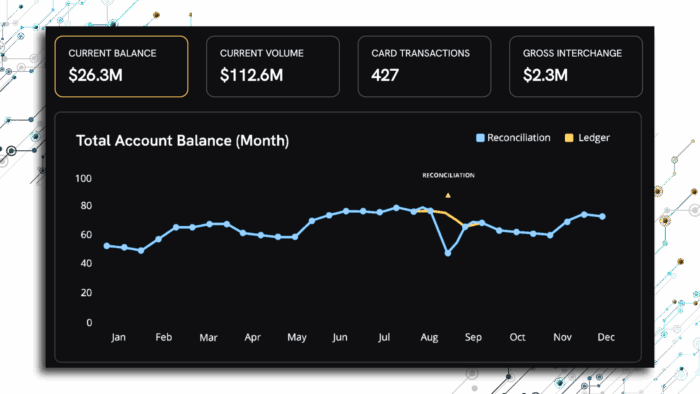

Unified Platform Integration

Unlike standalone virtual card solutions that require separate reconciliation processes, Qolo’s virtual cards are built on the same Quantum Ledger that handles your other payment types. ACH, wire, RTP, and card transactions all appear in a single view with consistent reporting and reconciliation processes.

Qolo’s platform also integrates seamlessly with leading accounting software and enterprise resource planning (ERP) systems, streamlining financial operations and ensuring efficient data synchronization across your business tools.

Real-Time Funding and Authorization

Qolo’s Sparq Controls Engine lets you set funding sources and authorization rules at the transaction level. A marketing virtual card can pull from the marketing budget account automatically. A vendor payment card can require dual approval for transactions over a certain threshold. Automated approval routing ensures that payment requests are sent to the appropriate approvers based on predefined rules, streamlining the approval process. These controls are enforced in real-time, not after the fact.

API-First Architecture

Integration shouldn’t require rebuilding your existing AP workflows. Qolo’s API-first approach means virtual card issuance can be embedded directly into your existing procurement and invoice approval systems. Features like optical character recognition and machine learning enhance data extraction and automate invoice processing, improving accuracy and efficiency. Generate cards programmatically based on purchase orders. Set spending limits based on approved budgets. Create audit trails that flow seamlessly into your ERP system.

Multi-Network Support

Qolo connects to major card networks through direct ISO connectivity, ensuring your virtual cards work with the vendors and platforms your business actually uses. No geographic restrictions or acceptance limitations that force you to maintain backup payment methods. Qolo’s platform also supports international payments, enabling businesses to transact globally with ease.

Aligning Treasury and Procurement with Virtual Cards

The real power of virtual cards in AP modernization comes from how they align traditionally separate functions.

By enabling finance departments to streamline payment processes, virtual cards improve the overall payment process across the organization, making digital payments more efficient and secure.

Treasury Gets Visibility

Treasury teams need to understand cash flow and spending patterns, but traditional AP processes create information delays.

Virtual cards provide real-time spending data that flows directly into treasury management systems. Cash flow forecasting becomes more accurate when you can see pending authorizations alongside settled transactions. Real-time data also enhances visibility into the accounts payable process, allowing treasury teams to monitor and control payments more effectively.

Procurement Gets Control

Procurement teams want to ensure spending stays within approved budgets and vendor relationships, but they shouldn’t have to manually review every transaction. Procurement leaders cite “rogue spend” as account for 10-15% of budgets. Virtual cards can be programmed with procurement policies built-in that mitigate that budget drain. Spending automatically flows to approved vendors within established categories and budgets. The AP team also benefits from automated controls that ensure compliance with procurement policies, streamlining payment processing and reducing manual intervention.

Finance Gets Efficiency

Finance teams need accurate books without manual reconciliation processes. Virtual cards create automatic matching between spending and budget categories. Transaction data includes detailed merchant information, making month-end close processes faster and more accurate. Automated exception handling flags discrepancies and ensures accurate financial reporting.

Shared Oversight and Reporting

Instead of separate systems for treasury, procurement, and AP, virtual cards create a unified view of business spending. Real-time dashboards show spending patterns across departments. Automated reporting eliminates the manual work of combining data from multiple payment systems. The platform also captures and consolidates data from incoming invoices and invoice receipt, providing comprehensive oversight and streamlining the reporting process.

The Path Forward for AP Modernization

Virtual cards represent more than just a new payment method; they’re a bridge between traditional AP processes and the kind of automated, intelligent payment systems that modern businesses need.

The companies that figure out virtual card integration first will have significant advantages in vendor relationships, cash flow management, and operational efficiency. But success requires more than just adding virtual cards to your existing payment mix. It requires rethinking how accounts payable connects to the rest of your financial infrastructure.

The question isn’t whether virtual cards will become standard in B2B payments. The question is whether your AP modernization strategy is ready to take advantage of them.

Ready to see how virtual cards can transform your accounts payable processes? Qolo’s unified platform makes it possible to issue, manage, and reconcile virtual cards alongside your other payment types – all through a single integration. Connect with us and get started today.