Cards are the profit engine that banks simply cannot ignore. Consider the numbers: the return on assets (ROA) for credit cards hovers between 3% and 6%, dwarfing the roughly 1% ROA for the average bank. Card spending itself accounts for over one-fifth of U.S. GDP and about a third of all personal consumption expenditures. With figures like these, cards are clearly a major opportunity for revenue and customer engagement.

Card programs can also be tailored to meet the needs of community bank customers, offering exclusive benefits and promotions that set these banks apart.

This raises a critical question for regional and community banks. If card programs are so profitable, why aren’t more of them building their own full-stack, in-house solutions? The answer is as simple as it is challenging: the operational and regulatory burdens are immense. For many banks, the cost and complexity of building from scratch outweigh the potential rewards. At the same time, there is growing demand among community bank customers for modern card programs that deliver convenience and value.

The traditional path to launching a card program involves piecing together a dizzying array of components and navigating a labyrinth of regulations. It’s a resource-intensive endeavor that pulls focus from a bank’s core mission of serving its community. But what if there was a better way? Instead of building from the ground up, community banks can now launch sophisticated, profitable card programs through turnkey partnerships. This approach offers the economics of a full-scale program without the operational headaches, creating a powerful new path to growth. Turnkey card programs also allow community banks to reinforce their brand identity through customized card solutions, ensuring a cohesive customer experience.

This post will explore why building an in-house card program is a regulatory nightmare and how turnkey solutions offer a smarter alternative. We’ll look at the evolving regulatory landscape, what it means for vendor partnerships and how to identify a “regulator-ready” turnkey provider.

Building a Card Program Is a Regulatory Nightmare

For many regional and community banks, the idea of launching a proprietary card program often starts with enthusiasm and ends with sticker shock. The sheer complexity of the technology stack required is daunting. It’s not just about printing plastic cards. A full in-house program requires integrating a core system, card issuing and processing, rewards platforms, fraud detection, collections, customer servicing and dispute operations. Each component is a major project in itself, and secure systems and data protection are critical throughout card program operations.

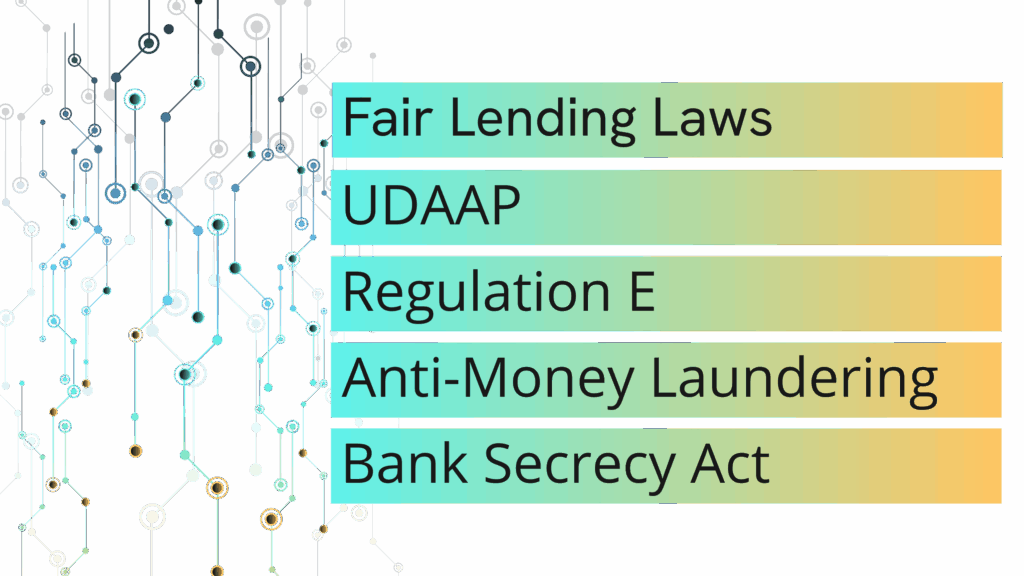

On top of this operational mountain lies a dense fog of regulatory requirements. Every new card product effectively creates a new regulatory perimeter that the bank must defend. This includes consumer compliance and fair lending laws, Unfair, Deceptive, or Abusive Acts or Practices (UDAAP) rules, Regulation E (Electronic Fund Transfers), Anti-Money Laundering (AML) and Bank Secrecy Act (BSA) protocols and stringent data and privacy requirements.

It’s no surprise that a survey from the Conference of State Bank Supervisors (CSBS) identified cybersecurity, regulation and technology implementation as the top three concerns for community bankers. The regulatory burden isn’t just a line item on a budget; it’s a constant operational strain that demands specialized expertise and significant resources. For most community banks, building and maintaining this infrastructure from scratch is simply not feasible. Regulatory compliance and operational stability must be maintained continuously to ensure program success. Effective strategies are also required to manage the complex regulatory and operational landscape.

The Turnkey Pivot: “Launching” vs. “Building”

The challenges of an in-house build have led to a strategic shift in thinking. Banks want the attractive economics of a card program but find the technology, compliance, rewards infrastructure and servicing too heavy a lift. This is where turnkey card programs come in. Instead of building, banks can now focus on launching.

So what does a “turnkey card program” actually mean? At its core, it’s a solution provided by a third-party partner that bundles the necessary components for a card program. This typically includes an issuer-processor, BIN sponsorship, and connectivity to card networks. A true turnkey solution goes further, providing a built-in ledger along with authorization, clearing and settlement workflows. Turnkey solutions also simplify onboarding for banks and their customers, making it easier and faster to get started with new card programs.

The most advanced turnkey solutions are built around a modern, embedded ledger. This isn’t just about the physical card. It’s about plugging into a system of virtual accounts, sub-accounts and program-level balances. These solutions now include virtual cards as part of a comprehensive card program offering, supporting credit, debit, and prepaid options. They also support a wide range of payment options, including both virtual and physical cards, to enhance user convenience and flexibility. This architecture provides granular control and real-time visibility into fund flows, which is a game-changer for managing commercial and small-business client relationships. By leveraging a turnkey partner, community banks can access a sophisticated, modern payments platform without the nightmare of building it themselves, while users benefit from seamless access to card services.

The Regulatory Catch: Third-Party Risk Is a Hot Topic

While turnkey solutions solve many operational problems, they introduce a new regulatory focus: third-party risk. Companies across various industries must manage third-party risk to protect their operations, ensuring regulatory compliance, operational resilience, and cybersecurity. Outsourcing a function does not mean outsourcing responsibility. Federal regulators have made this crystal clear with the interagency Third-Party Relationships: Risk Management Guidance. This guidance emphasizes that banks remain on the hook for any activities they outsource, especially those deemed “critical.”

Regulators now expect banks to conduct robust due diligence on their vendors, structure contracts carefully, perform ongoing monitoring and have clear exit plans. Ongoing support from vendors is crucial to ensure compliance and operational resilience. The new Community Bank Guide on Third-Party Risk gives both examiners and banks a shared checklist, effectively making vendor oversight a formal examination lane. If a bank can’t demonstrate strong governance over its partners, it will face scrutiny.

What does this mean for turnkey card providers? It means the bar is higher than ever. A modern partner must provide more than just technology. It must deliver exam-ready documentation, including Service Organization Control (SOC) reports, penetration tests and policy libraries. It must commit to clear Service Level Agreements (SLAs), provide performance metrics and offer evidence of its resilience and security. Insights gained from risk management activities can improve compliance and security, helping banks protect sensitive data and financial assets through robust third-party risk management. Additionally, understanding and managing the specific terms of vendor contracts and regulatory requirements is essential.

OCC Tailoring and What It Means for Partners

Recent moves by the Office of the Comptroller of the Currency (OCC) suggest a shift in the regulatory environment. The OCC has proposed rules to simplify licensing and “reduce regulatory burden for community banks,” particularly those with under $30 billion in assets. This concept of “regulatory tailoring” is welcome news, but it shouldn’t be misinterpreted.

Regulatory tailoring does not mean banks can “do whatever they want.” Instead, it offers more flexibility for banks that can demonstrate disciplined risk management, especially in their vendor selection processes. Adopting effective strategies for vendor selection and risk management is essential for achieving regulatory compliance and operational continuity. It acknowledges that a one-size-fits-all approach to regulation is not always appropriate for community banks.

For turnkey card partners, this shift raises the stakes. The value proposition is no longer just about speed to market. It’s about providing a solution that helps banks launch faster and satisfy the rigorous interagency third-party playbook. The ideal partner must prove it can deliver both card-level economics and regulatory peace of mind. This dual capability is what separates a simple vendor from a true strategic partner in today’s market, where trust between community banks and their turnkey partners is essential for successful program implementation.

What a Regulator-Ready Turnkey Solution Looks Like

In this heightened regulatory climate, a turnkey card solution must be a comprehensive bundle of technology and compliance. It needs to provide the tools for community banks to compete while also arming them with the documentation to satisfy examiners. Turnkey solutions should support a variety of payment methods, including debit cards and digital wallets, to enable seamless and secure transactions for both consumers and businesses.

A “regulator-ready” solution should have these key features:

A Combined Tech and Compliance Bundle

The platform should offer configurable card and spending rules that are directly tied to a real-time ledger and virtual accounts. This provides precise control over funds. For commercial and small-business clients, the ability to see balances at both the program and sub-account levels is crucial for cash management. This level of visibility helps businesses optimize their funds and helps banks deepen their client relationships.

Robust Risk and Governance Documentation

A modern partner must provide a standardized due diligence package. This includes SOC reports, penetration test results, comprehensive policy libraries and model risk summaries. The platform should also have built-in dispute workflows and complete audit trails for all card and account activity. This documentation is not a “nice-to-have”; it is essential for demonstrating sound oversight to regulators.

Strong Commercial Outcomes

Ultimately, a turnkey program must deliver tangible business results. The primary benefit is a dramatically faster launch time, taking months instead of years. This allows community banks to quickly tap into new revenue streams. By partnering with a turnkey provider, banks can share in the higher ROA of card programs without the massive overhead of hiring an entire card operations team. This creates a clear path to profitability and growth.

Incentives and Rewards: Driving Cardholder Engagement

Community banks can’t compete on scale. But they can win on rewards programs that actually matter to their customers. The question isn’t whether to offer incentives. It’s whether those incentives create real value or just add noise to already cluttered wallets.

Customers don’t just want rewards, they want to feel known. When a community bank offers relevant benefits tied to real spending habits, card usage doesn’t just increase; it becomes intentional. Higher transaction volumes follow naturally. Cross-selling stops feeling pushy when the bank already demonstrates it understands customer needs. Revenue grows, but more importantly, relationships deepen.

Your Path to a Modern Card Program

The landscape of financial services is changing, and community banks face increasing pressure to innovate. As card programs and payment technologies continue to evolve, they drive innovation in community banking. While the idea of building a full-stack card program from scratch is a non-starter for most, the opportunity to offer competitive card products remains. Turnkey card programs, powered by embedded finance platforms, provide a viable and attractive path forward.

The central question for regional and community banks is not “build or buy?” Instead, it is: “Which partner can give us card-level economics plus third-party-risk peace of mind?” The right partner will offer more than just a technology platform. They will provide a comprehensive solution that combines modern infrastructure with bank-grade integrity, enabling community banks to launch, automate and control payment programs at scale.

Choosing a partner that understands the regulatory environment and is prepared to stand with you during an exam is critical. By selecting a “regulator-ready” turnkey provider, community banks can confidently step into the future of payments, capture new revenue and better serve their customers without getting bogged down in operational and regulatory complexity.