Corporate clients don’t just want real-time cash visibility and liquidity control anymore. They expect it. They need streamlined reconciliation and a clear financial picture now. With Virtual Account Management (VAM), companies gain a real-time, consolidated view of their cash positions across all business units, subsidiaries, or projects.

The benefit of VAM is clear: it delivers significant benefits to organizations of all sizes, including many businesses and small businesses. VAM typically improves efficiency, streamlines financial control, and enhances cash management, making it a valuable solution for diverse organizational needs.

In response, many banks point their best corporate clients to external treasury management or liquidity systems. This approach feels like an easy fix, but it’s a dangerous one. It risks turning the bank’s core function into a commodity and puts your most valuable corporate relationships on a conveyor belt to someone else’s balance sheet.

The opportunity is massive, and it’s right in front of you. By keeping Virtual Account Management (VAM) in-house, you can deepen client relationships, create a powerful defensive moat, and capture a greater share of the $1.3 trillion global transaction banking revenue pool. By consolidating funds into one or a few master accounts, companies save on the bank fees and administrative overhead associated with maintaining many separate physical bank accounts. VAM also streamlines accounting and finance processes within treasury operations, enabling more efficient reporting, reconciliation, and financial management.

The High Cost of Outsourcing VAM

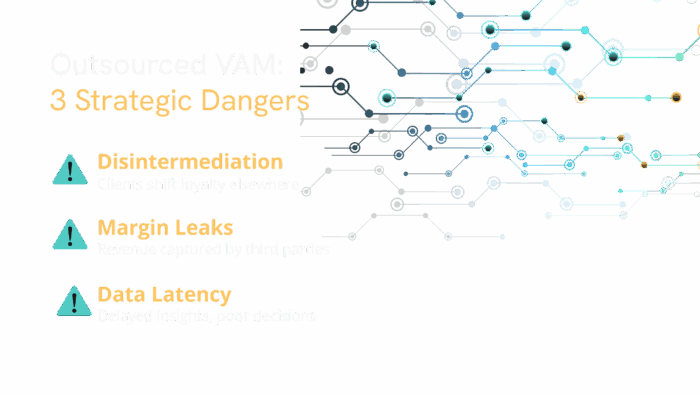

Every time you send a client to a third-party platform, you are handing over strategic ground. The long-term costs of outsourcing VAM far outweigh any short-term convenience. Outsourcing VAM disrupts the process of delivering integrated treasury services and diminishes the value-add banks can provide.

Disintermediation and Commoditization

When an external platform manages the user experience, your bank is demoted to a simple utility provider. The client’s primary relationship shifts to the third party, making it easier for them to switch their primary banking partner. You become the plumbing, not the partner. And when you are just the plumbing, the lowest bidder always wins.

Margin Leakage

Third-party platforms are monetizing services that banks are perfectly positioned to offer and profit from. Every reconciliation fee, every reporting subscription, every automation add-on that an external platform sells is money you could (and should) be capturing.

Data Latency

The standard file or API feeds from banks to treasury management systems introduce a critical lag. In a world that runs on real-time information, this latency is a significant drawback. If a corporate treasurer waits even 30 minutes for updated balances, it could equate to millions in misallocated funds. In-house, real-time VAM eliminates these blind spots. Real time payments further enhance the speed and accuracy of cash management and reconciliation, enabling instant updates and more efficient financial operations. VAM provides up-to-the-minute reporting, offering granular, detailed views of each virtual account’s activity and balance.

The Strategic Case for In-Bank VAM

Bringing VAM in-house is not just about adding another product. It’s about fundamentally strengthening your market position and owning the client relationship.

By implementing rationalized account structures and leveraging virtual bank accounts, organizations can streamline treasury operations, enhance liquidity management, and achieve greater transparency and operational efficiency.

Own the Relationship

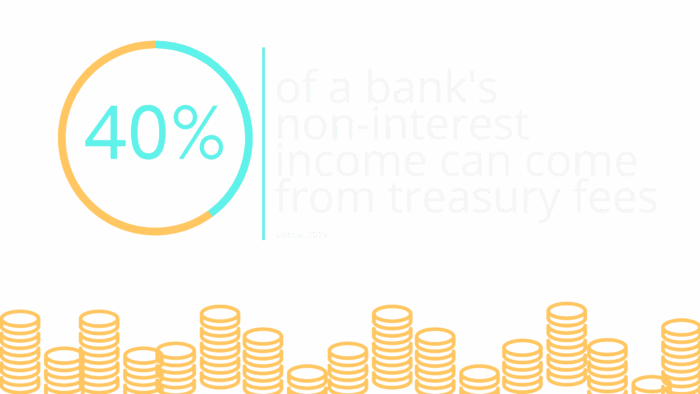

Treasury services fee income is a key driver of commercial bank profitability. According to McKinsey, treasury fee income represents almost 40% of a commercial bank’s non-interest income. Would you really hand that growth engine to someone else? Implementing an in-house VAM solution reinforces your role as a trusted advisor, enabling clients to manage liquidity with precision. This builds long-term client loyalty.

Own the Data

Banks are the ultimate source of truth for deposits and payments. Why let intermediaries complicate access to your clients’ data? An in-house VAM solution simplifies flows by removing layers and providing instant visibility into all accounts and sub-accounts. Oracle research highlights how VAM reduces operational risk, increases automation, and improves forecasting accuracy. With Qolo’s Quantum Ledger, you can offer a real-time, bank-grade ledger that tracks every transaction and balance with unmatched precision. Each instance of a virtual account can be tracked individually, enabling precise reconciliation and detailed reporting for every unique setup. While funds don’t physically reside in virtual accounts, a balance is maintained on a virtual ledger, reflecting the financial activity of that specific virtual account.

Own the Revenue

The global transaction banking market is valued at $1.3 trillion. Banks that directly manage treasury services capture a larger share of this revenue. High-performing banks consistently grow faster by monetizing these services in-house instead of outsourcing. VAM solutions let banks retain control over fee structures and unlock new revenue streams through value-added services.

Own the Risk Control

Banks already excel at Know Your Customer/Business (KYC/KYB) and Anti-Money Laundering (AML) compliance. Bringing VAM in-house builds on this strength, reducing the risks and compliance gaps associated with third-party intermediaries. Platforms like Qolo’s provide full transparency with detailed transaction histories, enhancing accountability and streamlining audits. Centralizing funds in a single physical account and using unique identifiers for transactions can lessen exposure to hacking risks.

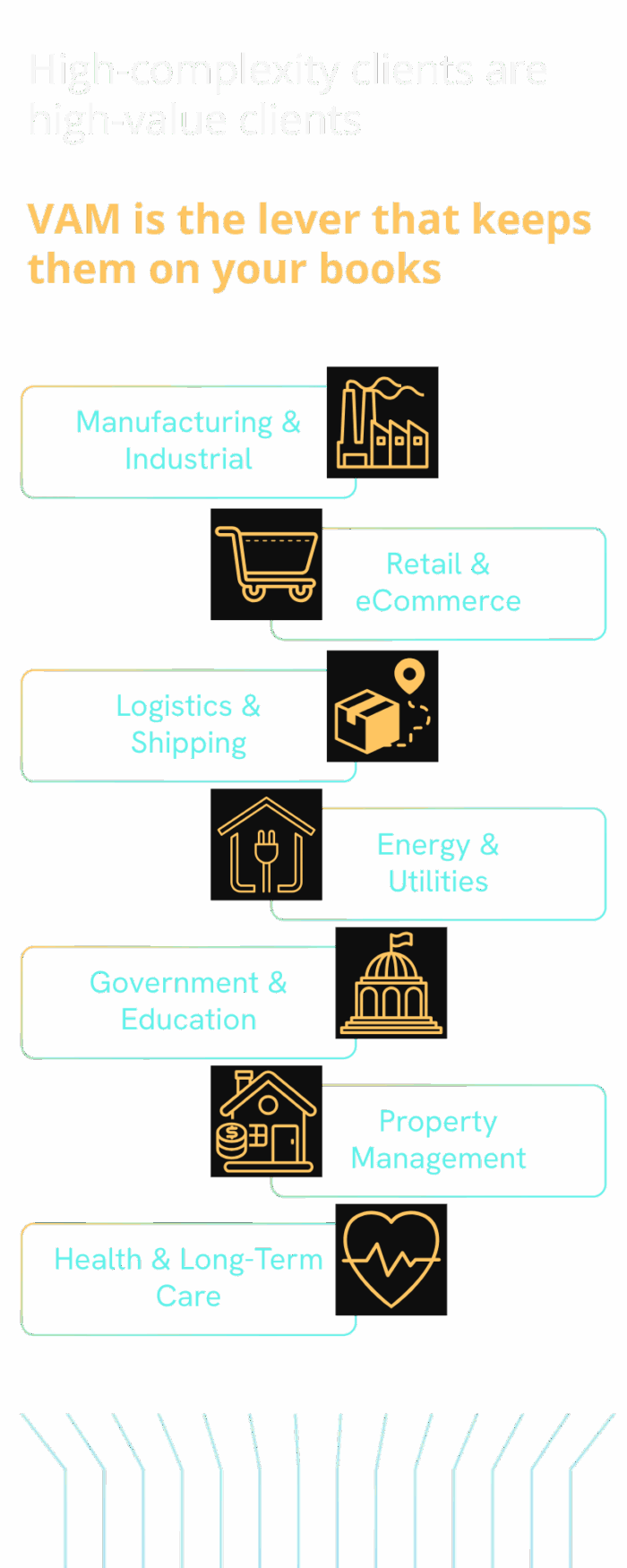

Industries Demanding Bank-Led VAM

Certain industries with complex financial structures are already pushing for better VAM solutions. Banks that can meet this demand will win their business. For large corporations, VAM provides a foundation for internal banking structures by tracking intercompany loans and transactions between subsidiaries. Centralized transaction processing enables organizations to manage cash flow more effectively across complex structures, streamlining reconciliation and improving visibility.

Let’s explore how in-bank VAM solutions can prove to be a win for commercial and corporate clients with complex account and payment needs.

Manufacturing and Industrials: An auto parts manufacturer with 120 subsidiaries across the country struggled with daily inter-company transfers. Their external treasury platform couldn’t reconcile fast enough, leaving cash stranded in dozens of accounts. By moving to in-bank VAM, they automated sweeps and unlocked millions in working capital, while also managing intercompany transfers and tracking sales revenue through virtual accounts.

Retail and eCommerce: A large eCommerce marketplace processed tens of millions of refunds annually. Every refund hit multiple bank accounts before being reconciled in a third-party system – creating weeks of backlog and skyrocketing costs. With in-bank VAM, the marketplace issued refunds directly from virtual sub-accounts tied to each merchant, cutting reconciliation time and strengthening loyalty with sellers.

Logistics and Shipping: A national freight forwarder managed payments across hundreds of vendor partners. External platforms left them waiting hours for balance updates, delaying settlement decisions. An in-bank VAM solution gave them real-time cash positions across sub-accounts and allowed them to release payments strategically, making payments efficiently to vendors and helping manage cash flow.

Energy and Utilities: An energy provider in a highly regulated environment needed granular audit trails for billions in annual payments. Third-party systems created reconciliation blind spots flagged by regulators. In-bank VAM gave them full transaction-level history, simplified compliance audits, and protected their reputation.

Government and Education: A state agency managing education funds for dozens of districts relied on external systems to segment funds. Delays in reporting led to budgeting disputes and compliance risks. In-bank VAM provided each district a dedicated virtual account within a parent structure and a transparent, auditable view of every dollar. Audit readiness dropped from weeks to days.

Property Management: A real estate group managing 10,000+ rental units juggled tenant deposits and payments across multiple bank accounts. External platforms introduced delays and errors in fund application. In-bank VAM enabled them to create property- and tenant-level virtual accounts, instantly reconciling rent payments and automating owner disbursements while reducing operational overhead, with the ability to pay owners and vendors directly from virtual accounts.

Health and Long-Term Care: A large hospital network processed payments from insurers, government programs, and patients across 50 facilities. External systems caused delays in matching inflows to invoices, extending their revenue cycle. With in-bank VAM, they established payer-specific virtual accounts that instantly reconciled receipts and improved liquidity positions. Each virtual account has a unique identifier, allowing businesses to assign them to specific customers or projects for precise tracking and reconciliation.

The Momentum Is Building

The shift toward in-house banking solutions is not a future trend; it’s happening now.

PwC’s 2025 Treasury Survey found that 67% of large corporations already run in-house banks that centralize financial operations in a single treasury center, and 60% use payment factories that consolidate payment processing into a controlled system. If you don’t provide bank-led VAM, someone else will.

The Future Is Orchestrated Liquidity

Commercial banking has always been about trust and control. Outsourcing VAM hands over both to another brand. The future of commercial transaction banking belongs to those that orchestrate liquidity – not those that rent it out. The only question is: will you be the bank that owns the relationship or the one that outsourced it away?

Want to discuss your VAM strategy? We’re ready.