For many business owners, securing loan approval is the easy part. The hard part? Actually getting access to the funds when they need them most.

While commercial lending has digitized nearly every step of the borrowing journey – applications move online, underwriting leverages advanced analytics, and approvals happen faster than ever – the final mile remains painfully outdated. Disbursement is still stuck on legacy rails, creating unnecessary friction at the exact moment businesses need liquidity most. Traditional banks often rely on outdated processes for disbursement, further slowing down access to funds.

This disconnect between modern lending workflows and antiquated funding methods isn’t just an operational headache. Inefficient disbursement processes used by banks create a competitive disadvantage that’s costing lenders revenue and market share.

The State of Commercial Loan Disbursement (Outdated & Broken)

SMBs drive 99.9% of U.S. businesses and generate 44% of economic activity, yet accessing approved capital often feels like stepping back in time.

Despite billion-dollar investments in digital lending platforms, most loan proceeds still arrive via ACH transfers that take 2-3 business days, wire transfers that are fast but inflexible, or in some cases, physical checks. Funds are typically deposited into business accounts, which can further delay access depending on the receiving bank’s processing times.

The numbers tell a frustrating story:

- 40% of small businesses report that delayed access to loan funds negatively impacts their operations (JPMorgan Institute)

- 70% of small business owners resort to personal credit cards when capital isn’t immediately available (Federal Reserve)

- ACH transfers average 2-3 days while wires, though faster, lack the flexibility and control modern businesses expect

Before disbursement can occur, businesses must complete the loan application, which is a crucial first step in obtaining funding. This process often requires submitting various documents, such as financial statements and legal paperwork, to verify eligibility and facilitate evaluation.

This creates a painful paradox. Businesses secure loans to solve immediate cash flow needs, then wait days to access the very capital meant to address those urgent requirements. Meanwhile, time-sensitive opportunities slip away. Inventory discounts expire, marketing campaigns get delayed, and payroll deadlines loom.

The Experience Gap in Business Lending

Consumer fintech has reset expectations for financial services. Venmo transfers happen instantly. Uber charges your card in real-time. Amazon delivers same-day. But commercial lending? Still operates like it’s 1995.

SMBs increasingly expect real-time access to capital, but they also need more than speed. They want flexibility, control and transparency over how they deploy borrowed funds. The ability to track spending, set controls and optimize cash flow isn’t a nice-to-have – it’s table stakes. Businesses also expect seamless payment options and efficient ways to manage loan repayments as part of their financial operations.

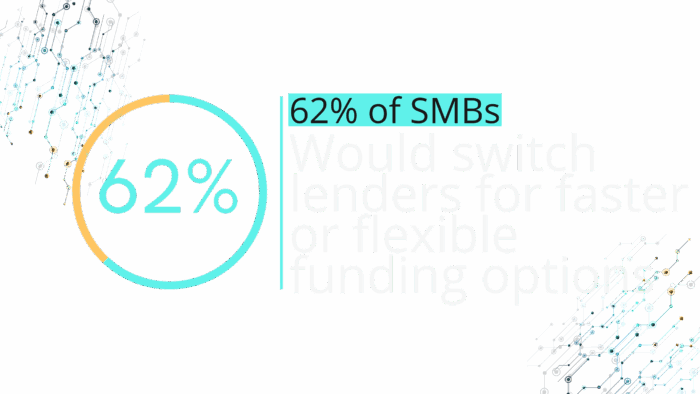

This expectation gap creates real business consequences:

Embedded lending is projected to grow 40% CAGR through 2030 (Allied Market Research), driven largely by borrower demand for integrated, flexible solutions

62% of SMBs say they would switch lenders for faster or more flexible funding options

Lenders risk customer churn when borrowers don’t see value beyond competitive rates

The message is clear: businesses don’t just want capital anymore. They want capital that works the way modern businesses operate.

Why Platforms Must Modernize Now

The competitive landscape is shifting rapidly. Non-bank fintech lenders are already innovating around disbursement, offering virtual cards, instant funding and integrated spend management. Traditional lenders who cling to legacy disbursement methods aren’t just falling behind – they’re becoming irrelevant.

The stakes couldn’t be higher:

Competitive pressure is intensifying.

Fintech lenders like Credit Key, Brex, Ramp and other companies are transforming the lending landscape by providing innovative financial platforms and digital banking solutions. Their integrated approach to lending and spending has raised the bar across the industry.

Revenue is at stake.

Outdated disbursement methods increase customer acquisition costs and reduce borrower retention. When your loan approval process is digital but your funding process is analog, borrowers notice. They also remember.

Regulatory trends favor transparency.

Regulators increasingly push for better tracking of loan fund usage. Financial institutions must now disclose all fees, including interest rates and origination fees, to protect borrowers from unfair lending practices. Modern disbursement methods that provide real-time visibility into how capital is deployed aren’t just competitive advantages, they’re compliance necessities.

What a Next-Gen Disbursement Model Looks Like

The solution isn’t just faster payments. It’s programmable capital.

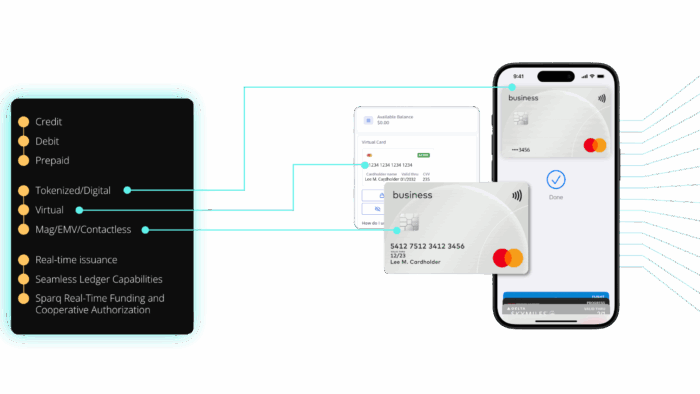

Modern disbursement platforms enable loan proceeds to be disbursed instantly to virtual cards that borrowers can use immediately. This transforms static loan disbursement into dynamic, controllable spending.

Here’s how it works for borrowers:

- Access capital same day rather than waiting 2-3 business days

- Use funds anywhere cards are accepted instead of being limited to bank account transfers

- Track spend automatically with real-time transaction data that eliminates manual expense tracking

- Manage repayment more effectively with integrated spending insights and cash flow visibility

- Access a line of credit for flexible, revolving funding options tailored to business needs

- Easily manage your repayment plan through integrated platforms that help schedule and track payments

For lenders, the benefits are equally compelling:

- Improve borrower satisfaction through instant access and flexible spending options

- Gain real-time visibility into how loan funds are being used across different business categories

- Enable smarter repayment models based on actual spending patterns and business performance

- Unlock interchange and rebate revenue from card transactions, creating new income streams

- Enhance security with features that protect both lenders and borrowers, including collateral management and secure transactions

- Track pledged assets used as collateral, such as real estate, equipment, or inventory, to ensure proper risk management

Case in Point: Credit Key

Credit Key leveraged Qolo to transform their business capital disbursement model. Instead of traditional bank transfers, approved borrowers receive virtual cards instantly loaded with their loan amount. Before funds are disbursed, borrowers must sign the loan agreement, ensuring all legal documentation is complete. The digital signing process streamlines the experience, allowing for efficient, secure, and legally valid electronic signatures. Borrowers submit their application and required documents prior to reaching the funding stage, which is the critical phase where final approval and disbursement occur.

The results speak volumes. Borrowers get faster access to capital with unprecedented control over how they deploy it. Credit Key gains visibility into fund usage while reducing the operational burden of manual loan servicing.

This isn’t theoretical innovation, it’s proven infrastructure powering real business outcomes.

Compete on Experience, Not Just Rate

Interest rates are increasingly commoditized. Every lender can offer competitive pricing, especially in today’s market. But experience? That’s where differentiation lives.

The lenders who win the next decade won’t just approve loans quickly. They’ll deliver capital with speed, control and flexibility. During the approval process, lenders may request additional information, such as supplementary documents or details, to ensure responsible lending and avoid delays. They’ll understand that modern businesses don’t just need money; they need money that moves the way they do.

Qolo sits at the heart of this transformation. Our unified platform combines real-time ledgering, instant card issuing and multi-rail money movement to give lenders the infrastructure they need to modernize disbursement without rebuilding their entire technology stack. Businesses can use loan funds to invest in growth opportunities or leverage existing equity for expansion or refinancing. Loan proceeds can also be used for purchases that drive profit and support business operations. The importance of paying back loans on time cannot be overstated, as being paid up improves business credit and financial health. A well-structured repayment plan ensures that businesses are consistently paying their obligations and maintaining responsible financial behavior.

The future of commercial lending isn’t just about approving loans faster. It’s about delivering capital smarter. Lenders who embrace programmable disbursement today will own the relationships tomorrow.

Ready to transform how your business delivers capital? Connect for a roadmap discussion today.