Rising interest rates and economic uncertainty are squeezing cash flows across middle-market firms. Companies earning $50 million to $1 billion annually face a brutal reality: traditional payment methods aren’t cutting it anymore when every dollar, and every day, counts.

Working capital represents the lifeblood of business operations. It’s the difference between your current assets and current liabilities, measured through key metrics like Days Payable Outstanding (DPO), Days Sales Outstanding (DSO), and the Cash Conversion Cycle (CCC). The faster you can convert inventory and receivables into cash while extending your payables, the stronger your liquidity position becomes. Optimizing working capital through virtual cards can directly strengthen a company’s financial position by improving liquidity and providing a clearer view of overall financial health.

But here’s where it gets interesting: virtual cards aren’t just another payment method. They’ve evolved into a strategic lever for optimizing working capital, offering float benefits, improved cash flow predictability, and meaningful cost reductions that can transform your financial operations.

The Working Capital Crunch Hitting Middle Market

Economic headwinds are forcing companies to get creative with cash management. Inflation continues pressuring costs, supply chain disruptions create unpredictable expenses, and credit tightening makes traditional financing harder to secure. Middle-market firms need more agility than ever to navigate these challenges. The numbers tell the story.

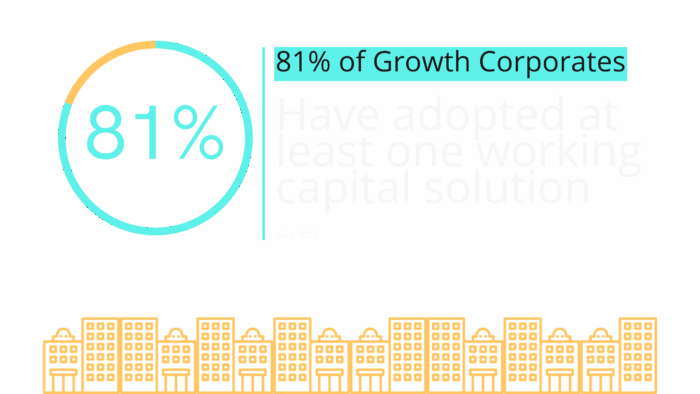

According to the Visa/PYMNTS Growth Corporates Working Capital Index 2024-2025, 81% of “Growth Corporates” (companies with annual revenue $50M-$1B) have adopted at least one working capital solution.

These aren’t just small tweaks. They’re fundamental shifts in how companies manage cash flow.

Metrics like Days Payable Outstanding (DPO) and Days Sales Outstanding (DSO) highlight the importance of both accounts payable and accounts receivable, while accounts payable represents obligations to suppliers, accounts receivable is a current asset reflecting money owed by customers. Both play a crucial role in determining a company’s working capital

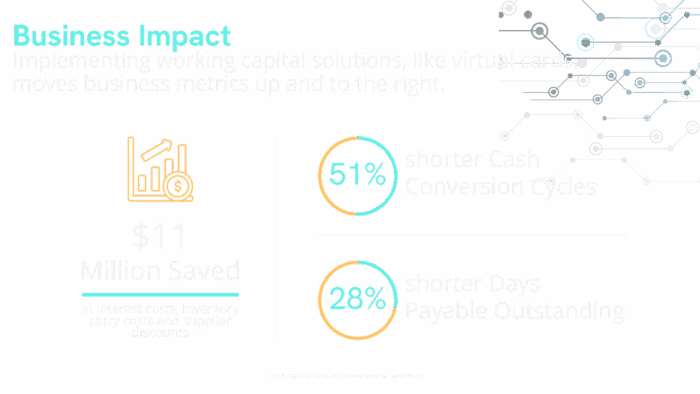

Top-performing companies are seeing dramatic results. They’ve saved an average of $11 million in interest costs, inventory carrying costs, and supplier discounts; a 300% increase from 2023. Even more impressive, these high performers have achieved 51% shorter cash conversion cycles and 28% shorter DPO compared to bottom performers. These results are driven by their ability to effectively manage accounts payable, streamlining processes to free up cash and improve the company’s working capital position.

The message is clear: companies that master working capital optimization aren’t just surviving the current economic climate, they’re pulling ahead of the pack.

What Makes Virtual Cards a Working Capital Game-Changer

Extended Float Creates Free Money

Virtual cards offer something traditional payment methods can’t match: extended float periods that keep cash in your accounts longer. Unlike wire transfers or ACH payments that immediately drain your bank account, virtual cards create a buffer between when you incur expenses and when funds actually leave your account.

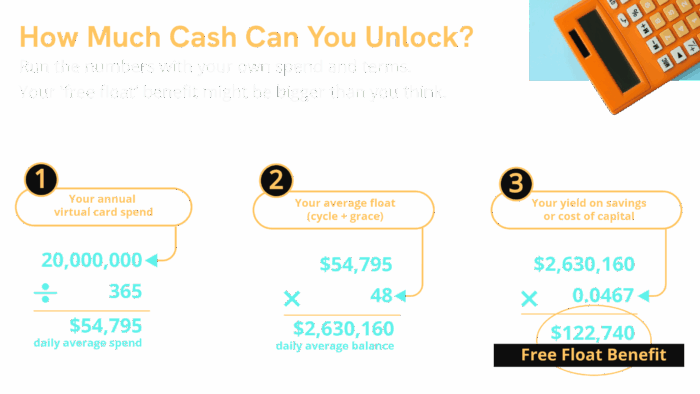

Most corporate virtual cards operate on 30-day billing cycles with additional grace periods. According to research, companies deploying $20 million in virtual card spend with 48 days of float can generate approximately $122,740 per year in “free float benefit”. By strategically delaying payments through virtual cards, businesses can optimize cash flow and working capital while maintaining control over their accounts payable process.

This isn’t just theoretical – it’s money you can reinvest, earn interest on, or use to cover unexpected expenses while your scheduled payments remain intact.

On-Demand Flexibility When Cash Gets Tight

Traditional corporate payment methods lock you into rigid processes. Need to pay a new supplier quickly? Virtual cards enable you to pay suppliers instantly, improving your responsiveness. Set up a wire transfer and wait for approvals. Unexpected equipment failure requiring immediate parts? Hope your purchasing department can move fast enough.

Virtual cards flip this dynamic. You can issue new cards instantly, set specific spending limits, tie cards to individual projects or suppliers, and turn them on or off as needed. When 42% of growth corporates cite handling unplanned expenses as a top reason for using working capital solutions, according to PYMNTS research, this flexibility becomes crucial.

Data-Driven Cash Flow Predictability

Every virtual card transaction generates rich, structured data that manual processes simply can’t match. This includes detailed invoice data, giving you real-time visibility into spending patterns, supplier relationships, and cash flow timing that helps you forecast more accurately.

The Growth Corporates Working Capital Index by Visa shows that top performers are far less likely to report unpredictable financing needs compared to bottom performers. Better data leads to better planning, which leads to better funds management.

Real-World Applications Across Industries

Virtual card usage among Growth Corporates jumped 32% year-over-year, with middle market firms in North America increasing usage by 54% while shifting away from traditional tools. Accounts payable automation is a key driver of this trend, as companies leverage automation to streamline AP processes, reduce manual tasks, and improve accuracy, making virtual cards an attractive option. This isn’t a gradual transition. It’s a fundamental shift in how companies manage B2B payments. Let’s explore how finance teams are putting virtual cards to work.

Supplier Payment Optimization

Smart companies use virtual cards to capture early payment discounts without sacrificing fund flow. Instead of choosing between keeping cash in the bank or getting a 2% early discount, virtual cards let you do both. You get the discount, the supplier gets paid faster, and your cash stays available for 30-45 days. This approach also helps maintain good vendor relationships by ensuring timely payments and building trust with your suppliers.

Emergency Expense Management

Supply chain disruptions and operational interruptions don’t wait for budget approvals. Virtual cards provide instant payment capabilities with built-in controls, and customizable workflows enable tailored responses to urgent supplier needs, allowing you to respond quickly while maintaining spending oversight.

Project-Based Spending Control

Rather than opening new credit facilities for specific projects, virtual cards offer granular control with predetermined limits and expiration dates. The payable team plays a crucial role in overseeing project-based spending with virtual cards, ensuring invoices are verified, approvals are obtained, and transactions are accurately recorded for compliance. This approach works particularly well for marketing campaigns, equipment purchases, software subscriptions, and professional services.

Industry-Specific Success Stories

Middle market companies in agriculture, traditionally challenged by long growing cycles and capital-intensive operations, have found virtual cards particularly valuable for managing seasonal variations and supplier contracts across extended payment cycles. Virtual cards also help streamline payments for raw materials, enabling companies to negotiate better pricing and payment terms with vendors.

Implementation Challenges to Navigate

Supplier Adoption Hurdles

Not all suppliers embrace virtual card payments immediately. Card processing fees, integration complexity, and unfamiliarity with the technology can create resistance. An efficient accounts payable system can streamline supplier onboarding and reduce resistance by ensuring clear documentation and communication. Success requires educating suppliers about faster payment timing and reduced collections risk.

Cost-Benefit Analysis Complexity

Card processing fees might seem expensive compared to ACH or wire transfers, but this narrow view ignores float benefits, discount capture opportunities, and administrative cost reductions. Streamlining the payables process with virtual cards can further reduce costs by automating payments and improving efficiency. Comprehensive ROI calculations, such as the float analysis above, reveal the true value proposition.

Internal Control Requirements

Virtual cards require robust internal controls to prevent misuse. Without proper spending limits, approval workflows, and automated invoice approval processes, the flexibility that makes virtual cards valuable can become a liability. Automated invoice approval is essential for maintaining strong internal controls, as it ensures that payments are authorized efficiently and reduces the risk of manual errors or fraud.

Technology Integration Limitations

Some suppliers and merchant systems don’t accept virtual card payments, limiting implementation scope. Using compatible accounting software is essential to maximize virtual card integration, as it streamlines automation and improves transaction accuracy. Success requires identifying high-value use cases where virtual cards provide maximum benefit.

Best Practices for Strategic Implementation

Start with High-Impact Opportunities

Focus initial virtual card deployment on supplier relationships where early payment discounts are available and payment volumes are significant. Prioritize suppliers or departments with high levels of manual invoice processing, as these areas are often inefficient and prone to errors, making them ideal candidates for automation and immediate improvement. These scenarios provide immediate ROI while building internal expertise.

Leverage Smart Controls

Issue virtual cards with project-specific limits, supplier restrictions, and defined expiration dates. Integrating AP automation with virtual card controls further enhances efficiency and oversight, leveraging technology to streamline the accounts payable process. This approach maximizes control while maintaining the flexibility that makes virtual cards valuable for working capital optimization.

Integrate with Existing Systems

Connect virtual card platforms with your ERP and accounts payable systems for real-time data flow, automated reconciliation, and improved cash flow forecasting accuracy. Integrating virtual cards with broader financial systems enables centralized data management and more accurate financial reporting.

Educate Your Supplier Network

Help suppliers understand virtual card benefits including faster payment timing and reduced credit risk. Virtual cards also provide clear visibility into what the business owes to each supplier, improving transparency and making it easier to track outstanding obligations. Position the change as a partnership improvement, not just a payment method switch.

Monitor Key Metrics

Track DPO improvements, cash conversion cycle changes, working capital ratio trends, cost savings from captured discounts, and supplier satisfaction levels to measure program success and identify optimization opportunities. Monitoring the AP process – including invoice receipt, verification, approval, payment, and record keeping – can help uncover additional areas for streamlining and efficiency gains.

The Strategic Advantage of Virtual Card Integration

Virtual cards represent more than a payment innovation. They’re a strategic working capital tool that can fundamentally improve your company’s financial agility. As competition for capital intensifies, companies that master virtual card implementation will enjoy significant advantages.

The evidence is compelling: top-performing companies are already saving millions of dollars annually while achieving dramatically improved cash conversion cycles. The technology exists, supplier acceptance is growing. Integrating virtual cards with your accounting system is crucial for seamless financial management, reducing errors, and improving efficiency. The economic benefits are proven.

For finance leaders evaluating their working capital toolkit, virtual cards deserve serious consideration alongside traditional credit facilities and cash management solutions. Start with a pilot program, measure the impact, and scale based on results. Your cash flow – and your competitive position – will benefit from the strategic advantage that virtual cards provide.

Ready to explore how virtual cards could optimize your working capital strategy? Companies already seeing $11 million in annual savings didn’t wait for perfect market conditions. They acted when the opportunity became clear. Connect with Qolo today to discuss how virtual card strategies can work for your business.